Proxy Statement SummaryHere are highlights of important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote. Summary of Shareholder Voting Matters

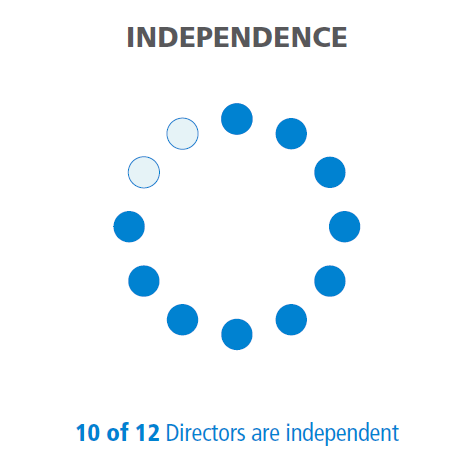

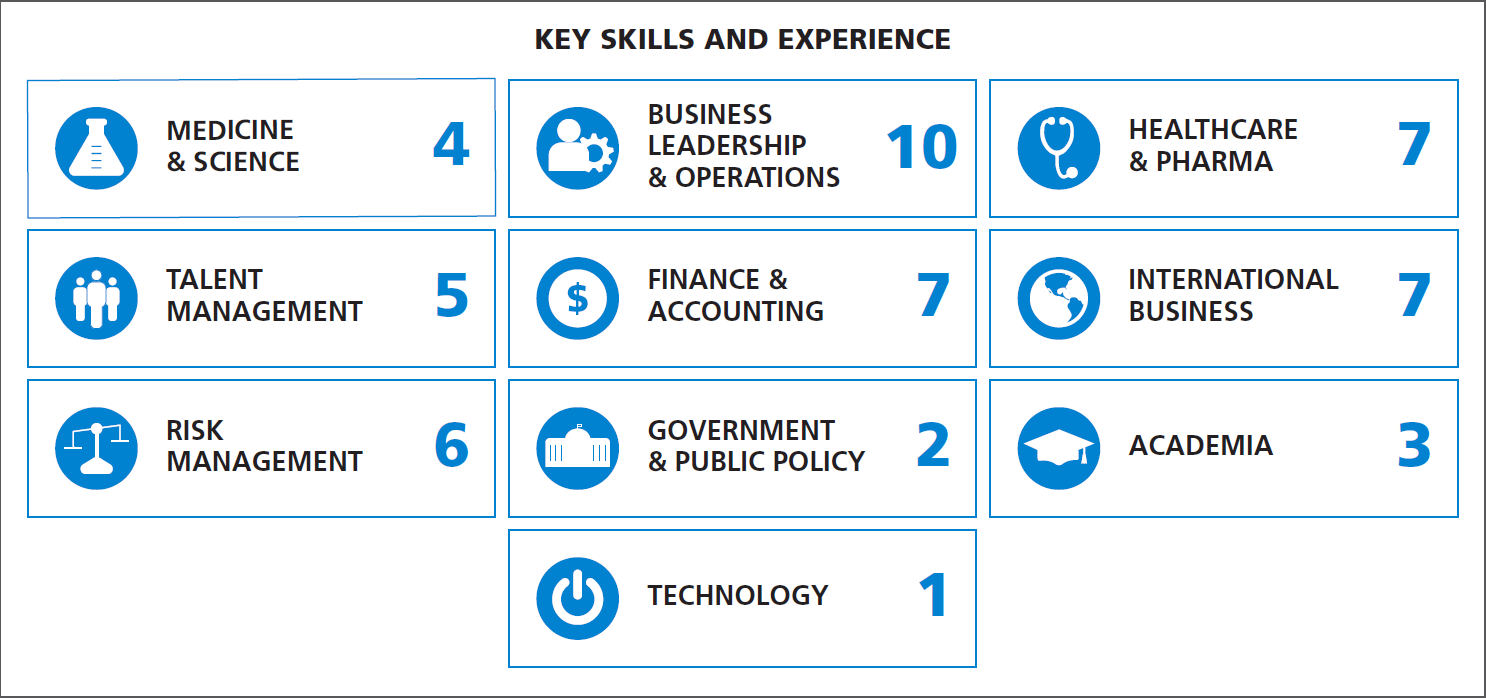

Our Director NomineesYou are being asked to vote on the election of the following 12 Directors. All Directors are elected annually by the affirmative vote of a majority of votes cast. For detailed information about each Director's background, skill sets and areas of expertise, please see "Director Nominees" later in this Proxy Statement.

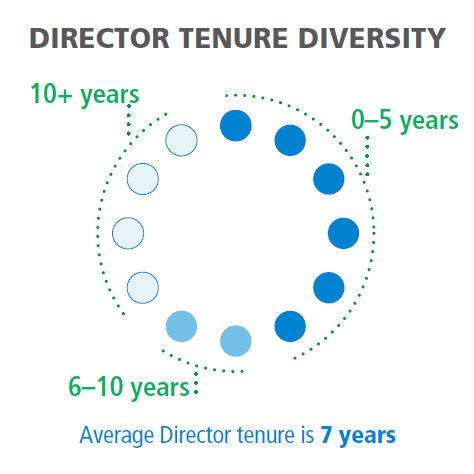

Board CompositionOur goal is to maintain a diverse Board representing a wide range of experience and perspectives. Below we highlight the composition of our Director nominees. Corporate Governance HighlightsPfizer is committed to exercising and maintaining strong corporate governance practices. We believe that good governance promotes the long-term interests of our shareholders, strengthens Board and management accountability and improves our standing as a trusted member of the communities we serve. 2017 Shareholder OutreachWe believe that a robust shareholder outreach program is an essential component of maintaining our strong corporate governance practices. In our discussions with investors, we seek their input on a variety of corporate governance topics and other issues that may impact our business or reputation. We strive for a collaborative approach with investors to solicit and understand a variety of perspectives. During 2017, we solicited feedback from investors representing approximately 40% of our outstanding shares and engaged with over 30 global institutional investors representing nearly 30% of our outstanding shares. Such engagement included the participation of our Lead Independent Director when requested. Overall, investors’ sentiment was positive with respect to our Board of Directors, our corporate governance practices (including our robust shareholder engagement program) and our executive compensation program. This information was summarized and shared with the Board of Directors. One area of particular focus during our engagements with investors was the right of our shareholders to call a special meeting. In part due to shareholder feedback we received, the Board took action in December 2017 to amend the company’s By-laws to reduce the percentage of outstanding stock required for shareholders to call a special meeting of shareholders from 20% to 10%. For more information about our 2017 shareholder engagement program and the actions we took in response to shareholder feedback, see “Governance — Board Information — Corporate Governance Committee Report” and “Governance — Shareholder Outreach” later in this Proxy Statement. Executive Compensation HighlightsPfizer’s pay-for-performance compensation philosophy is set by the Compensation Committee of the Board. Our goal is to align each executive’s compensation with Pfizer’s short-term and long-term performance and provide the compensation and incentives needed to attract, motivate and retain key executives crucial to Pfizer’s long-term success. To achieve these objectives:

2017 KEY ELEMENTS OF EXECUTIVE COMPENSATIONDirect compensation for our executives in 2017 consisted of the following key elements:

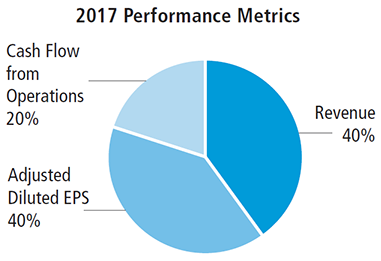

Element: Salary (Cash) Type/Description: The fixed amount of compensation for performing day-to-day responsibilities is set based on market data, job scope and responsibilities, and experience. Objective: Provides competitive level of fixed compensation that helps to attract and retain high-performing executive talent Element: Annual Short-Term Incentive/Global Performance Plan (GPP) (Cash) Type/Description: Our annual incentive plan pool is funded based on performance against Pfizer's short-term financial goals (revenue, adjusted diluted earnings per share (EPS) and cash flow from operations). Individual awards are based on business/operating unit and individual performance measured over the current year

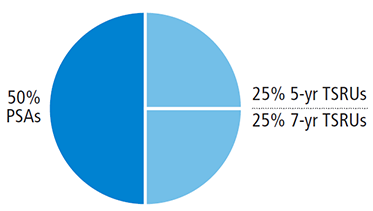

Objective: Provides incentives for achieving short-term results that create sustained future growth Element: Annual Long-Term Incentive Compensation (100% Performance-Based Equity) Type/Description:

Objective: TSRUs provide direct alignment with shareholders as awards are tied to absolute total shareholder return over a five- and seven-year period PSAs align executive compensation to operational goals through performance against a combination of operating income* over three one-year periods and TSR relative to the NYSE ARCA Pharmaceutical Index (DRG Index) over a three-year performance period * Operating income, as the PSA performance measure, is based on Pfizer’s Non-GAAP Adjusted Operating Income (as calculated using the “Reconciliation of GAAP

Reported to Non-GAAP Adjusted Information — Certain Line Items” table in our 2017 Financial Report), adjusted to reflect budgeted foreign exchange rates for

the year and further refined to exclude other unbudgeted or non-recurring items.

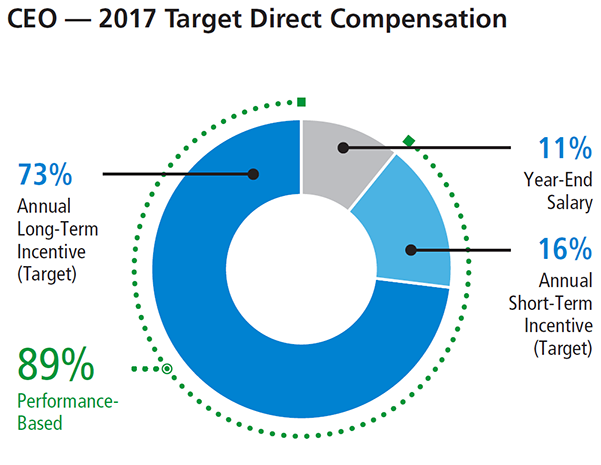

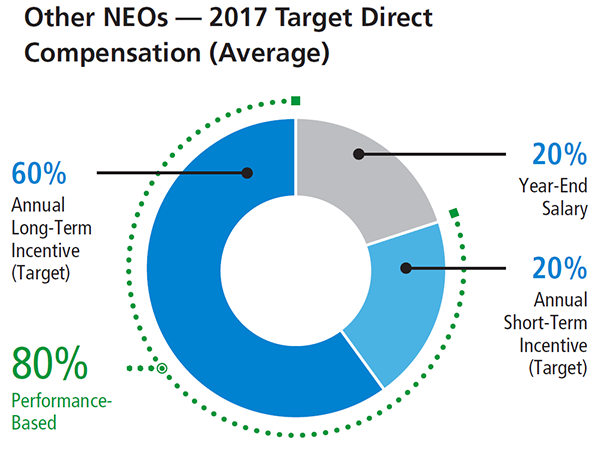

2017 NAMED EXECUTIVE OFFICER (NEO) PAY MIXThe illustration below uses year-end salary and target annual short-term and long-term incentive awards for the NEOs to show the percentage each pay element comprises of our NEOs' target direct compensation for 2017.

KEY PLANNING CYCLEThe below graphic illustrates key elements of the annual compensation planning cycle: APPROVE

REVIEW

ENGAGE

JANUARY–MARCH

APRIL–JUNE

JULY–SEPTEMBER

OCTOBER–DECEMBER

JULY–SEPTEMBER

Our Compensation PracticesPfizer continues to implement and maintain leading practices in its compensation program, including these practices:

For additional information about Pfizer, please view our 2017 Financial Report (see "Appendix A") and our 2017 Annual Review at www.pfizer.com/annual. Please note that neither our 2017 Financial Report, nor our 2017 Annual Review is a part of our proxy solicitation materials. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||