Proxy Statement SummaryHere are highlights of important information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote. Summary of Shareholder Voting Matters

Our Director NomineesYou are being asked to vote on the election of the following 11 Directors. All Directors are elected annually by the affirmative vote of a majority of votes cast. For detailed information about each Director’s background, skill sets and areas of expertise, please see “Director Nominees” later in this Proxy Statement.

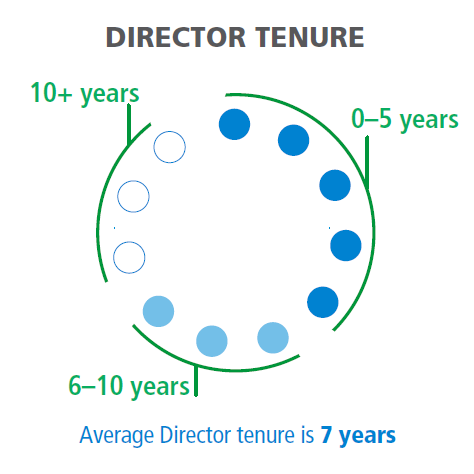

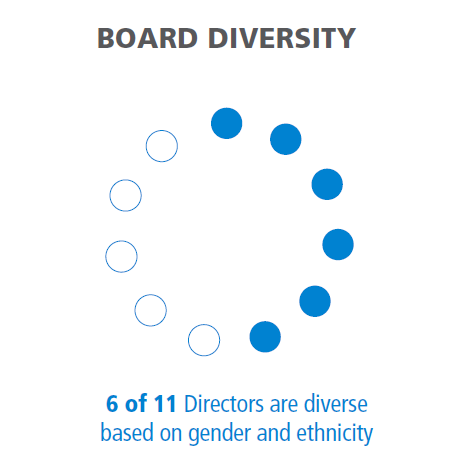

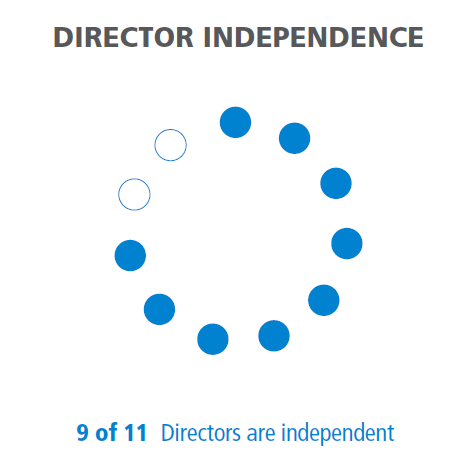

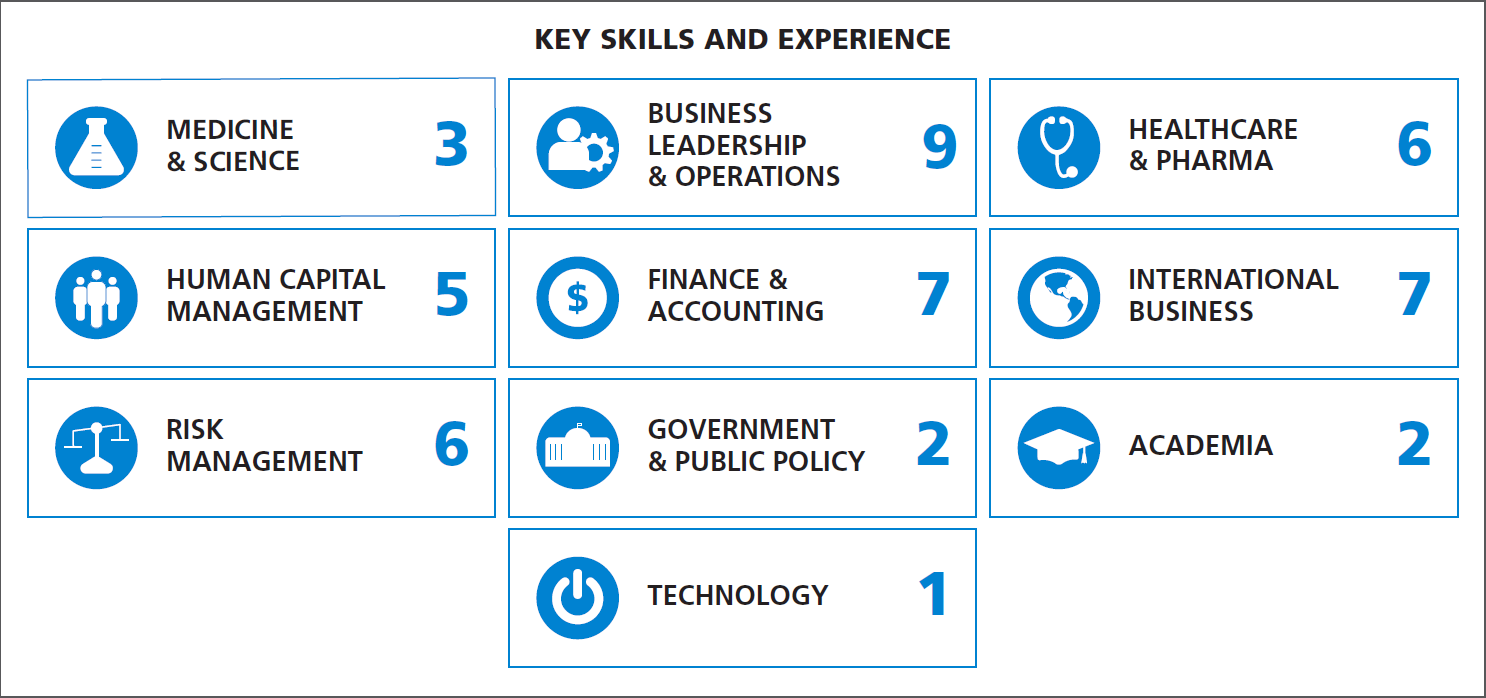

Chief Executive Officer SuccessionIn October 2018, we announced that the Board of Directors unanimously elected Dr. Albert Bourla, the company’s Chief Operating Officer, to succeed Mr. Ian Read as Chief Executive Officer (CEO), effective January 1, 2019. Mr. Read was elected to the role of Executive Chairman of the Board of Directors, effective January 1, 2019. Mr. Shantanu Narayen will continue in his role as Lead Independent Director. The Board believes this structure will help ensure continuity of strong and effective leadership. The election of Dr. Bourla was the result of a multi-year succession planning process, led by the independent Directors. During this timeframe, the Board had the opportunity to observe and evaluate Dr. Bourla in many different settings, including as a Board member since February 2018. The Board was continually impressed with Dr. Bourla’s business performance, depth of experience, proven leadership and track record for success and, therefore, elected him to lead the company into the future as CEO. Board CompositionOur goal is to maintain a diverse Board representing a wide range of experience and perspectives, which are important to enhancing the Board’s effectiveness in fulfilling its oversight role. Below we highlight the composition of our Director nominees. Corporate Governance HighlightsPfizer is committed to exercising and maintaining strong corporate governance practices. We believe that good governance promotes the long-term interests of our shareholders, strengthens Board and management accountability and improves our standing as a trusted member of the communities we serve.

Our Corporate Governance and Executive Compensation practices are informed by our long-standing,

comprehensive shareholder engagement program. In 2018, we engaged with more

than 30 investors representing over 30% of our shares outstanding. The Chair of the Corporate

Governance Committee participated in these discussions when requested.

2018 Shareholder OutreachWe believe that a robust shareholder outreach program is an essential component of maintaining our strong corporate governance practices. In our discussions with investors, we seek their input on a variety of corporate governance topics and other issues that may impact our business or reputation. We strive for a collaborative approach with investors to solicit and understand a variety of perspectives. During 2018, we solicited feedback from investors representing approximately 50% of our outstanding shares and engaged with more than 30 global institutional investors representing over 30% of our outstanding shares. Such engagement included the participation of the Chair of our Corporate Governance Committee when requested. Overall, investors’ sentiment was positive with respect to our Board of Directors, our corporate governance practices, including the frequency of our shareholder outreach, and our executive compensation program. Shareholder feedback was summarized and shared with the Board of Directors. Areas of particular focus during our engagements with investors included CEO succession planning, Board composition, with a focus on the recruitment process for new Director candidates, drug pricing, product safety, human capital management and the company’s sustainability priorities. For more information about our 2018 shareholder engagement program and the actions we took in response to shareholder feedback, see “Governance — Board Information — Corporate Governance Committee Report” and “Governance — Shareholder Outreach” later in this Proxy Statement. Executive Compensation HighlightsPfizer’s pay-for-performance compensation philosophy is set by the Compensation Committee of the Board. Our goal is to align each executive’s compensation with Pfizer’s short-term and long-term performance and provide the compensation and incentives needed to attract, motivate and retain key executives crucial to Pfizer’s long-term success. To achieve these objectives:

2018 KEY ELEMENTS OF EXECUTIVE COMPENSATIONDirect compensation for our executives in 2018 consisted of the following key elements:

Element: Salary (Cash) Type/Description: The fixed amount of compensation for performing day-to-day responsibilities is set based on market data, job scope and responsibilities, and experience. Objective: Provides competitive level of fixed compensation that helps to attract and retain high-performing executive talent Element: Annual Short-Term Incentive/Global Performance Plan (GPP) (Cash) Type/Description: Our annual incentive plan pool is funded based on performance against Pfizer's short-term financial goals (revenue, adjusted diluted earnings per share (EPS) and cash flow from operations). Individual awards are based on business/operating unit and individual performance measured over the performance year

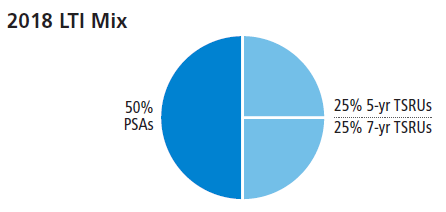

Objective: Provides incentives for achieving short-term results that create sustained future growth Element: Annual Long-Term Incentive Compensation (100% Performance-Based Equity) Type/Description:

Objective: TSRUs provide direct alignment with shareholders as awards are tied to absolute total shareholder return over a five- or seven-year period PSAs align executive compensation to operational goals through performance against a combination of operating income* over three one-year periods and TSR relative to the NYSE Arca Pharmaceutical Index (DRG Index) over a three-year performance period * Operating income, as the PSA performance measure, is based on Pfizer’s Non-GAAP Adjusted Operating Income (as calculated using the “Reconciliation of GAAP

Reported to Non-GAAP Adjusted Information — Certain Line Items” table in our 2018 Financial Report), adjusted to reflect budgeted foreign exchange rates for the

year and further refined to exclude other unbudgeted or non-recurring items. Effective in 2019, the Operating Income performance measure will be replaced with an

Adjusted Net Income performance measure for PSAs granted after 2017. For additional information, see the “Compensation Discussion and Analysis” section later

in this Proxy Statement.

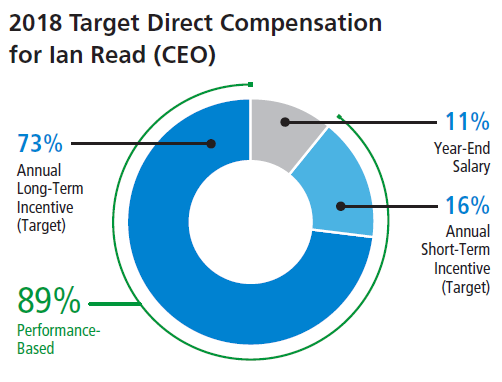

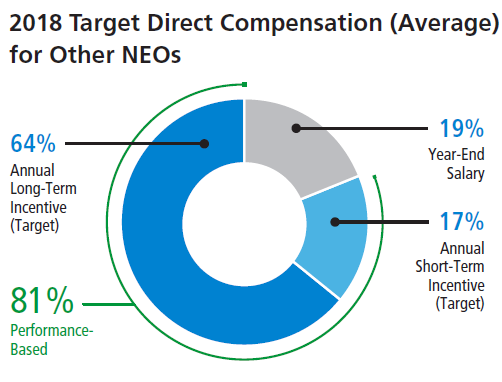

2018 NAMED EXECUTIVE OFFICER (NEO) PAY MIXThe illustration below uses year-end salary and target annual short-term and long-term incentive awards for the NEOs to show the percentage each pay element comprises of our NEOs’ target direct compensation for 2018.

KEY PLANNING CYCLEThe below graphic illustrates key elements of the annual compensation planning cycle*: APPROVE

REVIEW

ENGAGE

JANUARY–MARCH

APRIL–JUNE

JULY–SEPTEMBER

OCTOBER–DECEMBER

JULY–SEPTEMBER

* Includes actions with respect to our Executive Chairman, as applicable.

Our Compensation PracticesPfizer continues to implement and maintain leading practices in its compensation program, including these practices:

For additional information about Pfizer, please view our 2018 Financial Report (see “Appendix A”) and our 2018 Annual Review at www.pfizer.com/annual. Please note that neither our 2018 Financial Report, nor our 2018 Annual Review is a part of our proxy solicitation materials. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||